What are the problems that income protection solves for you?

Who will pay you when you can’t work? Most self-employed people don’t have any work cover.

How will you pay the bills if you can’t work? If you don’t have adequate cash savings this causes a lot of worry and stress. Even if you do have cash savings this may run out. Are you simply relying on your savings, when you may be saving this for something else? Income protection may be a cost effective solution.

You have insured your business and its assets, you have insured your home and your car. What happens if your income stops, who pays for this?

Unfortunately, you are not bulletproof, so you need a plan of action if something goes wrong.

Income protection is an accessible policy for most individuals, and can be relatively inexpensive. You get a regular income when you can’t work due to an illness or injury. The policy is customised for your needs when taking into account your current situation. Better still it is tax deductible.

Call our insurance specialist on 1300 307 955 or email info@suretylife.com.au to get an obligation free quote.

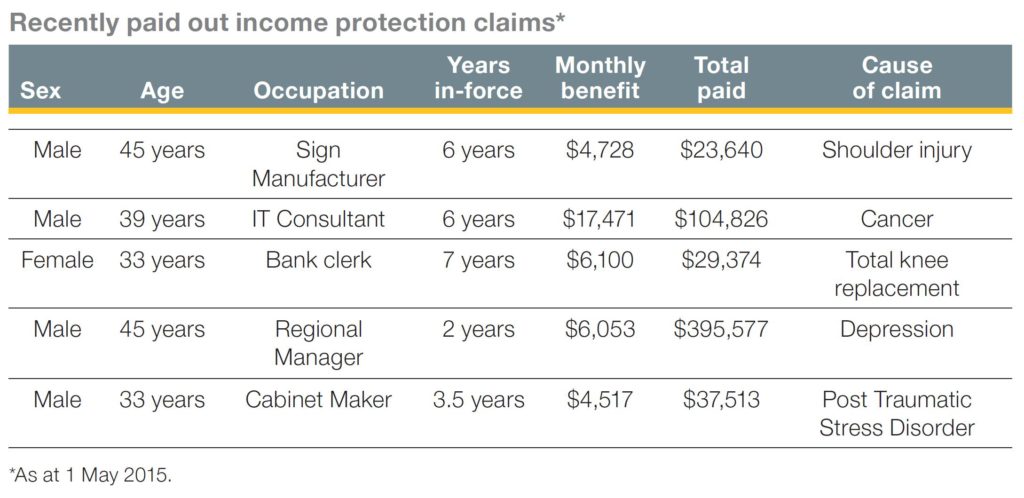

Refer below to example of claims paid for income protection (Prepared by CommInsure Document CIL1045 310515).

The information provided in this document, including any tax information, is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial situation or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out. This information is current as at January 2017.